All Categories

Featured

Think About Utilizing the DIME formula: DIME represents Debt, Earnings, Home Loan, and Education. Overall your debts, home loan, and university expenditures, plus your wage for the variety of years your household requires defense (e.g., until the youngsters are out of your home), and that's your protection demand. Some monetary experts determine the amount you require making use of the Human Life Value philosophy, which is your lifetime revenue potential what you're earning now, and what you anticipate to earn in the future.

One way to do that is to search for companies with strong Monetary stamina ratings. the term “illustration” in a life insurance policy refers to. 8A firm that underwrites its own plans: Some companies can sell plans from an additional insurance company, and this can add an additional layer if you desire to transform your policy or later on when your household needs a payment

The Term Illustration In A Life Insurance Policy

Some firms supply this on a year-to-year basis and while you can anticipate your rates to increase substantially, it might be worth it for your survivors. An additional means to contrast insurer is by taking a look at online customer reviews. While these aren't likely to tell you a lot about a business's economic stability, it can inform you exactly how very easy they are to collaborate with, and whether claims servicing is a trouble.

When you're younger, term life insurance policy can be a straightforward means to shield your enjoyed ones. As life modifications your monetary concerns can also, so you may want to have whole life insurance coverage for its life time protection and added benefits that you can make use of while you're living. That's where a term conversion can be found in - life insurance level term.

Approval is guaranteed regardless of your wellness. The premiums will not boost once they're established, yet they will go up with age, so it's a great idea to lock them in early. Figure out even more about just how a term conversion functions.

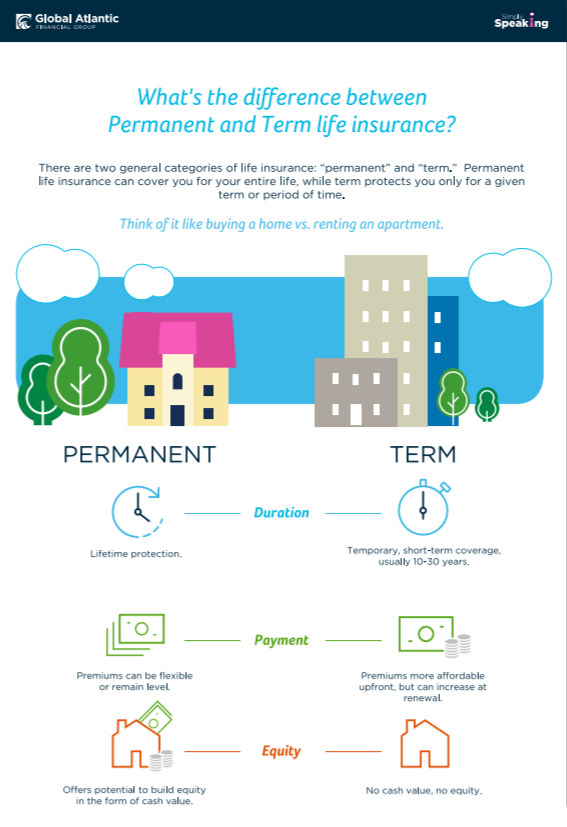

1Term life insurance policy provides short-term protection for a vital duration of time and is normally more economical than long-term life insurance policy. term life insurance for married couples. 2Term conversion guidelines and restrictions, such as timing, may apply; for instance, there might be a ten-year conversion privilege for some items and a five-year conversion benefit for others

3Rider Insured's Paid-Up Insurance Acquisition Choice in New York. There is a cost to exercise this rider. Not all taking part policy proprietors are eligible for returns.

Latest Posts

Term Life Insurance Vs Accidental Death And Dismemberment

Instant Quote Burial Insurance

A Whole Life Policy Option Where Extended Term Insurance