All Categories

Featured

The kid cyclist is acquired with the concept that your child's funeral expenses will be totally covered. Youngster insurance policy motorcyclists have a death benefit that ranges from $5,000 to $25,000.

Your child must additionally be between the ages of 15 days to 18 years old. They can be covered under this strategy until they are 25 years of ages. Note that this policy only covers your children not your grandchildren. Final expenditure insurance plan benefits do not finish when you sign up with a plan.

Riders are available in different types and present their own advantages and incentives for joining. Riders deserve checking into if these additional choices apply to you. Cyclists consist of: Faster fatality benefitChild riderLong-term careTerm conversionWaiver of premium The increased survivor benefit is for those that are terminally ill. If you are seriously sick and, relying on your details plan, established to live no longer than six months to 2 years.

The downside is that it's going to decrease the fatality advantage for your recipients. The kid motorcyclist is acquired with the idea that your child's funeral service costs will certainly be totally covered.

Insurance coverage can last up until the child turns 25. Note that you may not be able to authorize your child up if he or she endures from a pre-existing and lethal problem. The long-term treatment rider is comparable in principle to the accelerated fatality advantage. With this one, the concept behind it isn't based on having a short quantity of time to live.

For example, someone that has Alzheimer's and calls for daily help from health and wellness aides. This is a living benefit. It can be obtained against, which is really beneficial because long-term care is a substantial expenditure to cover. A year of having somebody take treatment of you in your home will certainly cost you $52,624.

Funeral Underwriters

The motivation behind this is that you can make the button without going through a clinical examination. final expense telesales from home. And since you will no more be on the term plan, this likewise indicates that you no more need to fret concerning outlasting your plan and losing on your survivor benefit

The specific quantity relies on various variables, such as: Older people typically encounter greater premiums due to enhanced health and wellness risks. Those with existing health problems may encounter greater premiums or constraints on protection. Higher insurance coverage quantities will normally lead to greater costs. Remember, plans typically top out around $40,000.

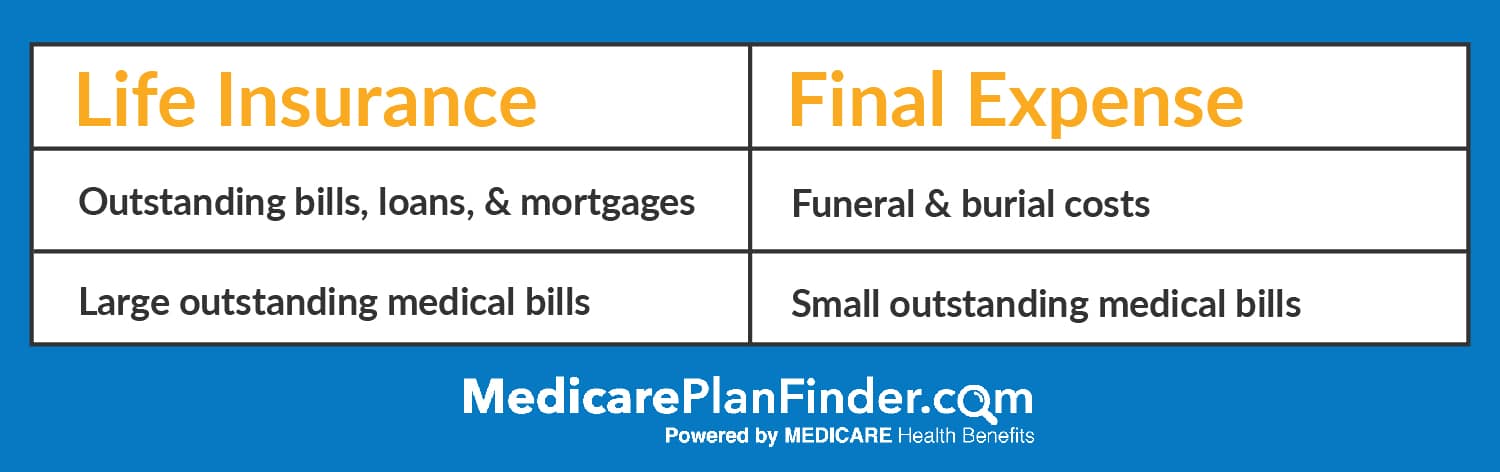

Think about the regular monthly costs payments, however also the assurance and monetary safety and security it gives your family members. For many, the reassurance that their enjoyed ones will not be burdened with monetary challenge throughout a hard time makes last expense insurance policy a worthwhile financial investment. There are two kinds of last expense insurance policy:: This kind is best for people in fairly good wellness that are looking for a means to cover end-of-life prices.

Protection amounts for simplified issue plans typically rise to $40,000.: This type is best for people whose age or health avoids them from buying other sorts of life insurance policy protection. There are no health and wellness requirements at all with ensured issue policies, so anybody who fulfills the age requirements can generally qualify.

Life Insurance For Cremation

Below are some of the elements you should take into account: Examine the application process for different plans. Some may require you to address health inquiries, while others supply guaranteed concern options. See to it the provider that you choose supplies the quantity of insurance coverage that you're searching for. Look into the settlement alternatives offered from each provider such as month-to-month, quarterly, or yearly premiums.

Latest Posts

Term Life Insurance Vs Accidental Death And Dismemberment

Instant Quote Burial Insurance

A Whole Life Policy Option Where Extended Term Insurance